Investment Approach Page

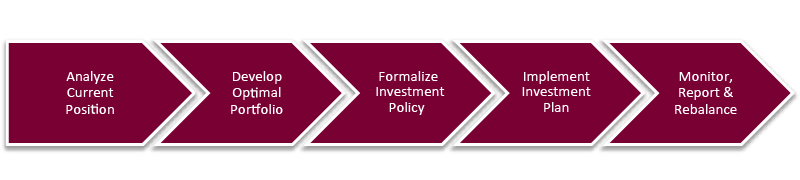

Our investment approach incorporates asset allocation using managed money to help create a diversified portfolio while managing risks and meeting a trust's investment objectives. This approach begins with the directives expressed in the governing trust document and the needs of the trust's current and future beneficiaries. Having a credible and repeatable investment process ensures a consistent approach to portfolio management. While working in collaboration with your Stifel Financial Advisor, highlights of the process include:

• Review, understand and interpret governing trust document.

• Consider time horizons, distribution needs, risk tolerance.

• Understand the needs of the current and future beneficiaries.

• Analyze current investments.

• Review Capital Market Assumptions.

• Examine current market and economic environments.

• Propose strategic asset allocation.

• Prepare written Investment Policy Statement.

• Determine policy benchmark and relevant risk measures.

• Establish procedures and time horizons.

• Outline distribution requirements if applicable.

• Propose appropriate investment structure.

• Select active or passive strategies.

• Determine investment products (Individual Securities, SMAs, Mutual Funds, ETFs).

• Review existing capital gain exposure and overlapping holdings.

• Transition portfolio.

• Provide ongoing supervision and investment structure analysis.

• Review and report performance.

• Determine need for changes to asset allocation and/or investment products.

• Rebalance as necessary.